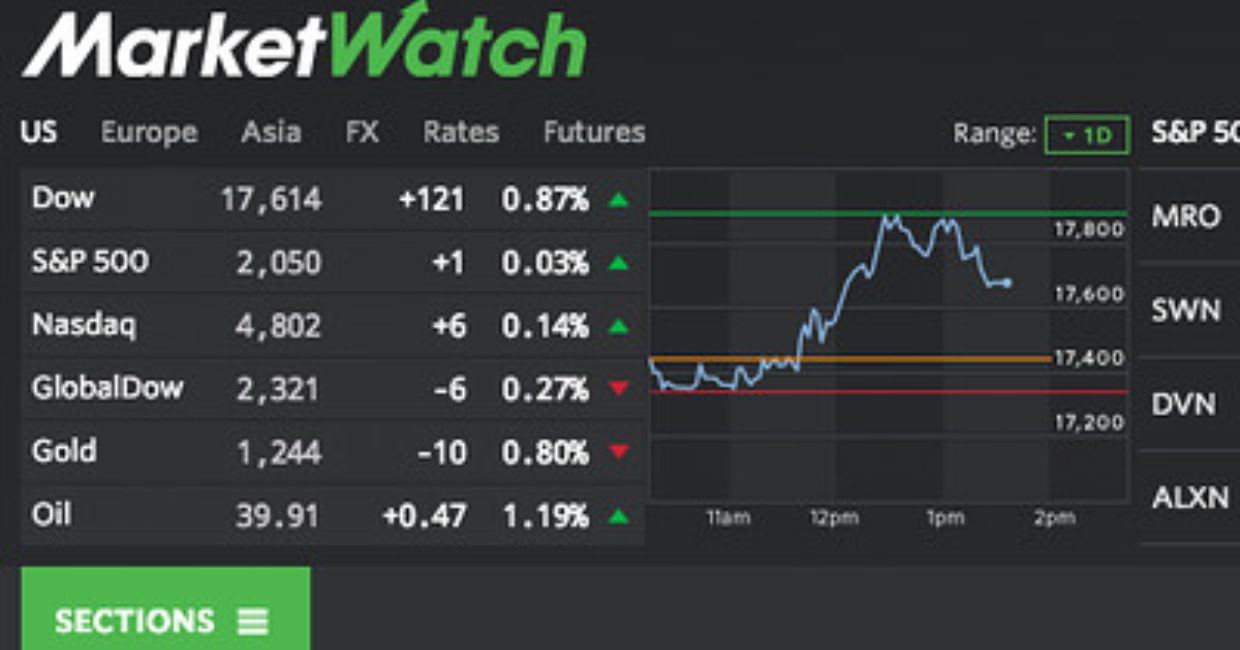

Market Watch: Top Stocks in Focus

Market Watch

Market Watch

The stock market is a constantly evolving ecosystem shaped by economic data, corporate earnings, investor sentiment, and global events. For both seasoned investors and newcomers, keeping a close watch on stocks that are currently in focus can offer valuable insights into broader market trends and emerging opportunities. This market watch report explores the top stocks attracting attention, the factors driving their performance, and what investors should consider before making decisions.

Rather than chasing short-term noise, successful investing often begins with understanding why certain stocks stand out at a given moment. Whether it is strong earnings growth, sector-wide momentum, innovation, or macroeconomic shifts, stocks in focus often act as indicators of where the market may be heading next.

Market Momentum: The Trends Driving Today’s Trading Session

Understanding Why Stocks Come Into Focus

Stocks do not gain attention randomly. They move into the spotlight for specific reasons that often reflect larger market dynamics.

Earnings Performance and Guidance

Quarterly earnings reports remain one of the most powerful drivers of stock movement. Companies that exceed revenue and profit expectations often experience sharp price movements, while weak guidance can lead to sell-offs. Investors closely track earnings trends to assess a company’s financial health and growth potential.

Macroeconomic and Policy Factors

Interest rates, inflation data, employment numbers, and central bank policies significantly influence stock valuations. For example, rate-sensitive sectors such as banking, real estate, and technology often move sharply in response to monetary policy signals.

Sector Rotation and Market Cycles

Institutional investors frequently rotate capital between sectors based on economic cycles. During periods of economic expansion, cyclical stocks like industrials and consumer discretionary companies often outperform. In uncertain times, defensive stocks such as healthcare and utilities may gain prominence.

Technology Stocks: Innovation Driving Market Momentum

Technology stocks continue to dominate market conversations due to their role in innovation and digital transformation. From artificial intelligence to cloud computing, the sector remains a key growth engine.

Large-Cap Technology Leaders

Major technology companies often act as market bellwethers. Their performance can influence broader indices and investor confidence. Strong balance sheets, consistent cash flows, and global reach make these companies attractive during both growth and uncertainty.

Key drivers for large-cap technology stocks include:

- Expansion in cloud services

- Investment in artificial intelligence and automation

- Strong consumer and enterprise demand

- Ongoing share buyback programs

Emerging Tech Innovators

Beyond established giants, mid-cap and emerging technology firms are also gaining attention. These companies often operate in niche areas such as cybersecurity, semiconductor design, or software-as-a-service platforms. While they may carry higher risk, they also offer significant upside potential for investors willing to tolerate volatility.

Banking and Financial Stocks: Riding Interest Rate Trends

Financial stocks have returned to the spotlight as interest rate movements reshape the lending environment. Banks, insurance companies, and asset managers respond directly to changes in monetary policy.

Commercial Banks

Rising interest rates often improve net interest margins for banks, increasing profitability from lending activities. However, credit quality and loan demand remain crucial factors to monitor.

Investors typically evaluate:

- Loan growth trends

- Asset quality and non-performing loans

- Capital adequacy and regulatory compliance

- Exposure to interest rate fluctuations

Insurance and Asset Management Firms

Insurance companies benefit from higher yields on fixed-income investments, while asset management firms gain from rising market valuations and increased investor participation. Market volatility, however, can impact fee-based revenues, making diversification a key strength in this sector.

Energy Stocks: Navigating Volatility and Transition

Energy stocks remain in focus due to fluctuating commodity prices and the ongoing transition toward renewable energy sources.

Traditional Energy Companies

Oil and gas companies continue to benefit from supply-demand imbalances, geopolitical developments, and production discipline. Strong cash flows have allowed many firms to reduce debt and increase shareholder returns through dividends and buybacks.

Key factors influencing energy stocks include:

- Crude oil and natural gas prices

- Global supply disruptions

- OPEC production decisions

- Refining margins and operational efficiency

Renewable and Clean Energy Players

As governments and corporations commit to sustainability goals, renewable energy stocks are gaining attention. Solar, wind, and electric vehicle-related companies are positioned for long-term growth, although they may face short-term volatility due to policy changes and capital costs.

Healthcare Stocks: Stability and Innovation Combined

Healthcare stocks are often viewed as defensive investments, yet innovation within the sector continues to attract growth-focused investors.

Pharmaceutical and Biotechnology Companies

Drug development pipelines, regulatory approvals, and clinical trial results can significantly impact stock prices. Larger pharmaceutical firms provide stability through diversified product portfolios, while biotech companies offer high-risk, high-reward opportunities.

Healthcare Services and Equipment

Hospitals, diagnostic companies, and medical equipment manufacturers benefit from aging populations and increased healthcare spending. Advances in medical technology and digital health solutions are further enhancing growth prospects.

Consumer Stocks: Tracking Spending Behavior

Consumer-focused stocks offer insight into household spending patterns and economic confidence.

Consumer Discretionary Stocks

These stocks tend to perform well during periods of economic expansion when consumers have higher disposable income. Retailers, automotive companies, and travel-related businesses fall into this category.

Performance drivers include:

- Employment levels

- Wage growth

- Consumer confidence

- Seasonal demand trends

Consumer Staples

Staples such as food, beverages, and household goods offer stability during economic slowdowns. These companies often maintain steady demand regardless of market conditions, making them attractive for risk-averse investors.

Industrial and Infrastructure Stocks: Building the Future

Industrial stocks are gaining attention as infrastructure investment and manufacturing activity increase.

Manufacturing and Engineering Firms

Companies involved in construction, machinery, and transportation benefit from government spending on infrastructure and private sector investment. Order backlogs and project pipelines are key indicators of future performance.

Defense and Aerospace

Geopolitical tensions and increased defense spending have brought defense stocks into focus. Long-term government contracts provide revenue visibility, although regulatory oversight remains strict.

What Investors Should Consider Before Investing

While stocks in focus offer opportunities, careful evaluation is essential before making investment decisions.

Valuation and Risk Assessment

A popular stock is not always a good investment. Comparing valuation metrics such as price-to-earnings ratios, growth rates, and cash flow helps determine whether a stock is fairly priced.

Diversification Strategy

Concentrating investments in a single sector or stock increases risk. A diversified portfolio across industries and asset classes helps manage volatility and protect capital.

Long-Term Perspective

Short-term market movements can be unpredictable. Investors who focus on long-term fundamentals often benefit from compounding returns and reduced emotional decision-making.

Market Sentiment and the Role of News

Market sentiment plays a powerful role in stock movements. News headlines, analyst reports, and social media discussions can amplify price swings, sometimes beyond what fundamentals justify.

Understanding sentiment helps investors distinguish between temporary hype and genuine long-term value. Staying informed without overreacting is a skill that develops with experience and discipline.

Conclusion: Staying Ahead in a Dynamic Market

The stock market is shaped by a combination of data, expectations, and human behavior. Stocks in focus provide valuable clues about economic trends, sector strength, and investor priorities. Technology innovation, financial sector dynamics, energy transitions, and consumer behavior all contribute to shaping today’s market landscape.

For investors, the key lies not in following every trend blindly, but in understanding why certain stocks attract attention and how they align with individual investment goals. By combining research, risk management, and patience, investors can navigate market volatility and identify opportunities that stand the test of time.

Keeping a disciplined approach and staying informed through market watch insights can turn uncertainty into opportunity and help investors build resilient portfolios in an ever-changing financial world.